Effortlessly embed custom finance solutions with Mamun, opening a world of possibilities for your enterprise

Contact Us

Customers & Partners

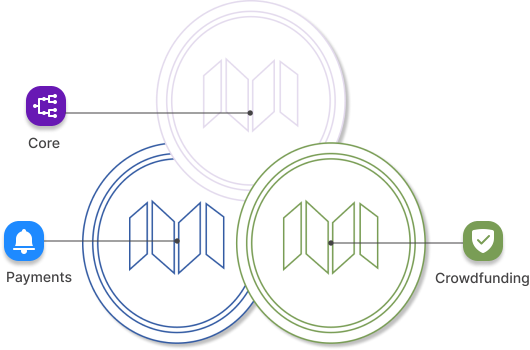

Core Platform Middleware

Mamun's Core Platform Middleware specializes in instant finance decisioning, origination, and servicing within an embedded finance framework. This module streamlines lending processes, empowering businesses to focus on their core operations while efficiently delivering financial services

Core

Payment

Payments

Explore Mamun's flagship eDirect Debit in the Payments suite, revolutionizing payment, collection, and reconciliation processes. This solution seamlessly embeds financial functionalities, optimizing transactions and allowing businesses to prioritize growth.

Finance Powered by Crowdfunding

Dive into Mamun's Finance Powered by Crowdfunding module, designed for SME investment and lending. This component amplifies financial growth opportunities, enabling businesses to engage in community-driven initiatives and diverse funding models.