The mamun Nominee Structure

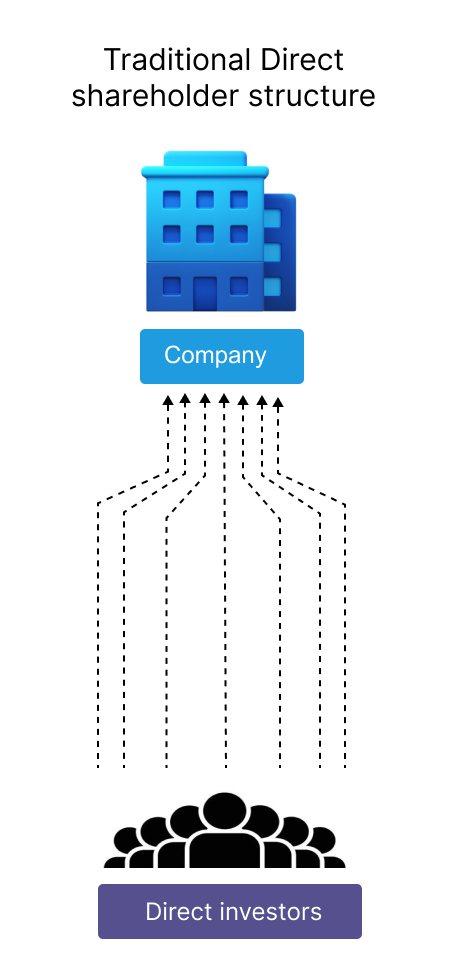

When you invest through our platform, Mamun or another designated shareholder of the company you invest in (such as the majority shareholder), is legally registered as the shareholder on your behalf. They handle all administrative shareholder tasks, and any financial benefits, such as dividends, capital returns upon exit, and tax benefits, are returned to you.

What does the Mamun Nominee mean for me as an investor?

In essence, it means that a Nominee holds the company's shares on your behalf when you invest through our platform. While the Nominee is the registered shareholder responsible for administrative tasks, the entire economic interest in the shares ultimately returns to you.

Benefits for investors with Nominee:

Easier Administration Process

Investing through the Nominee structure means your funds are securely held until the company reaches its fundraising target. After the investment, the Nominee handles all technical shareholder tasks, including reviewing and acting on resolutions, while enabling investors to easily monitor their investment and interact with the company through the platform.

Robust legal protections for your investment

Negotiating individual contractual protections can be challenging for numerous small investors. By consolidating smaller investments through the Nominee, the Nominee can acquire voting shares and establish minority shareholder protections that individual investors might struggle to secure.

Access to the Secondary Market

Nominee's Secondary Market offers investors the opportunity to trade commercial interests in shares. This not only provides an exclusive exit option for existing investors but also presents an enticing investment prospect for newcomers who may have missed the initial fundraising rounds of rapidly growing, innovative companies.

Benefits to Companies

The Nominee serves as a representative for startup investors, streamlining administrative responsibilities such as consents and votes. This consolidation of communication enables startups to concentrate on investor input. The simplified procedure ensures smoother future funding rounds, addressing issues associated with a dispersed investor network. The Nominee Structure strategy appeals to investors in later stages, making investments in companies backed by a Nominee more accessible.